In a press release dated July 26, 2022, the austrian tax office drew a preliminary result on the #yearlyTaxAssessments - which is probably known to most people under the terms #taxReturn.

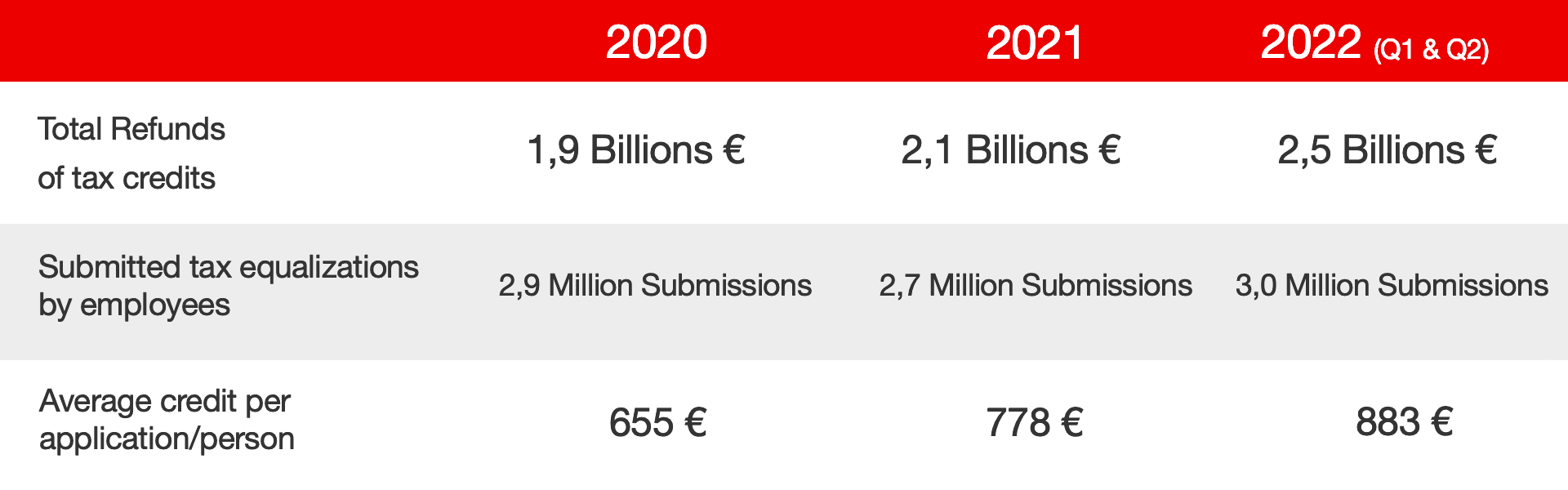

If you look at the statistical figures and compare the wage tax credits paid out with the applications submitted, i.e. tax adjustments, you can see a tendency for the tax refunds or credits to increase every year.

This represents a significant increase compared to previous years, when the average tax credit could be expected to be around €360 based on publicly available statistical data.

In the opinion of the tax experts at RelaxTax, this development can be attributed to three main reasons:

More employees have heard about the topic of tax returns and possible refunds in these years, dealt with it and often made applications for several tax years for the first time. Without an application, i.e. submission of a tax return, in most cases you will not be able to enjoy any refund at all

The pandemic resulted in fluctuating wages and salaries due to short-term work or job changes with e.g. receiving unemployment benefits for a certain period of time. This has a significant impact on the annual (re)calculation of the tax based on the annual income as part of the tax return

Since 2019, more and more tax-free and tax-deductible amounts have been introduced. For example, during the pandemic, allowances for working from home and the associated expenses or the family bonus plus as a tax credit for families with children.

Of course, based on the individual professional, private or family situation, which can change from one year to the next, there can of course be many other reasons that can lead to a tax refund.

The goal is clear, but the way there is very often associated with hurdles for many people.

RelaxTax, with its unique app service, would like to accompany anybody along the way so that they can reach their destination safely, reliably, easily and quickly - namely to be able to benefit from a possible tax refund.

Thousands of users have trusted RelaxTax since the start of our service in 2021 - join us and become one of them!

Über uns

Account

Steuerausgleich für

Verstehen

Unternehmen

Barrierefreiheit

Rechtliches

- Schnellster Steuerausgleich mittels elektronischer Übermittlung an das Finanzamt

- Produktpreise können sich ohne Benachrichtigung jederzeit ändern

- Die finale Berechnung und Beurteilung über Steuerguthaben oder -nachforderungen erfolgt ausschließlich durch das zuständige Finanzamt und wird mittels rechtsgültigen Einkommensteuerbescheid festgestellt

Kontakt

- Scheydgasse 24

1210 Wien, Österreich - contact@relax-tax.at

© 2025 relax-tax FlexCo - Alle Rechte Vorbehalten